The effects of the Brexit decision are still unfolding.

We are in un-chartered waters; nobody knows what is going to happen.

Immediately after the referendum we saw significant declines in business sentiment. Both the RIBA Future Trends and Markit Construction Purchase Managers’ Index showed significant drops. They have recovered to positive territory, though not to pre-referendum levels.

UK GDP, was widely expected to deteriorate following the referendum result, but has proved more robust. GDP grew by 0.5% in Q3 2016 (following growth of 0.4% and 0.7% in Quarters 1 and 2 respectively). The Bank of England, in its latest inflation report has revised its estimate for GDP upwards, at least for the short term.

Does this mean that the referendum will not have a detrimental effect on the UK economy? Were initial projections from the economists just wrong? Will the referendum result be beneficial to the UK economy in the short and medium term?

Current projections uniformly suggest that even though the economy is performing better than expected right now, the referendum result will be a downward pressure for at least the next two to three years. We might expect suppressed growth and higher public sector borrowing as a result.

At NBS we wanted to understand the views of the design community. Those who design buildings are often good predictors of what will happen to the broader construction industry. This is because design work is the earliest work; if it tails off, so too, in time, will construction output.

We last ran this survey in June and July. We have repeated it three months on. Interestingly, the design community follow a pattern we have seen elsewhere; a sudden and pronounced dip immediately following the referendum result, followed by a bounce back.

Current projections uniformly suggest that even though the economy is performing better than expected right now, the referendum result will be a downward pressure for at least the next two to three years.

The effect on workload

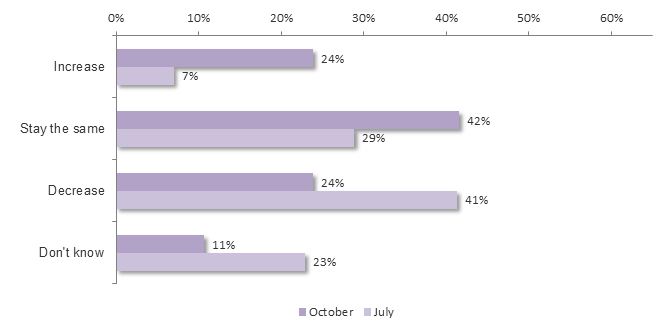

Predictions for practices’ workloads have markedly improved. In July, only 7% felt their workloads would increase in the coming twelve months. That figure has risen to nearly a quarter, 24%, the same number who expect a decrease. 42% anticipate no change.

We feel very positive about the future. Our sales pipeline continues to grow.

…uncertainty will result in a slowdown of investment in construction and infrastructure projects.

It has crossed my mind that the increase in work is because people have decided to get it done before Brexit really bite[s].

The effect on workload

Predictions for practices’ workloads have markedly improved. In July, only 7% felt their workloads would increase in the coming twelve months. That figure has risen to nearly a quarter, 24%, the same number who expect a decrease. 42% anticipate no change.

In the next 12 months my company's workload is more likely to:

The effect on staffing levels

I am aware of friends being laid off.

The GREAT in Britain is about to be unleashed. Every one under the age of 40 should prepare to cause the greatest entrepreneurial era since the industrial revolution.

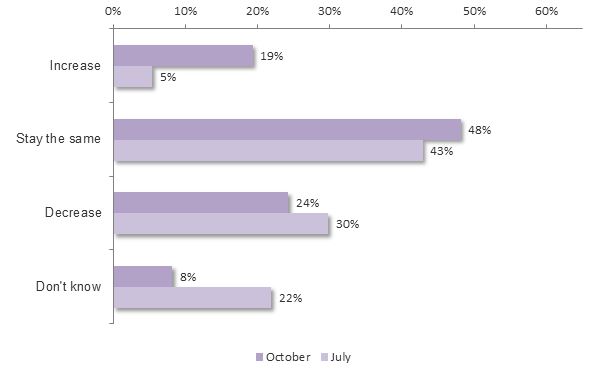

The latest figures around projected staffing levels are more stable than we saw in July. A quarter see staffing levels falling in the next twelve months. Nineteen percent foresee growth, compared with only 5% in July. Almost a half foresee no change in their staffing levels. On balance then, 5% more practices expect a reduction in staffing levels than expect growth. This is significant, but does not suggest that there will be a widespread loss of design staff by practices.

However, when we analyse the figures by practice size, we find that larger practices (with more than 50 staff) expect the most volatility; twenty two percent expect staff growth, and 38% expect a decrease. Relatedly, 29% of London practices expect staffing levels to contract. The larger the practice, the greater the number of staff exposed to change.

In the next 12 months my company's staffing level is more likely to:

The effect on the UK construction industry

[The Brexit decision] will lead to industry shrinkage and a possible recession.

No clear indication of the government plan for leaving the EU - this uncertainty will result in a slowdown of investment in construction and infrastructure projects.

[Construction activity] will return to pre-Brexit levels as people generally buckle down and realise that they still need things doing.

Construction industry forecasts, like those produced by the Construction Products Association and Experian, suggest that whilst we are not heading for a recession, construction output has been significantly dampened because of the Brexit decision. Uncertainty, rather than speculation about the ultimate form Brexit takes, is the root cause.

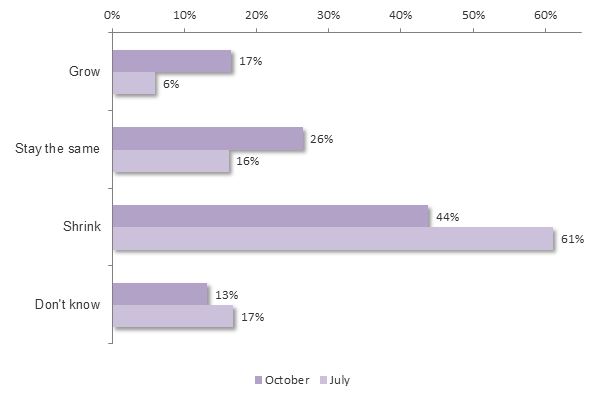

But designers are less negative than they were immediately after the decision. The number expecting the construction industry to shrink is still high, at 44%, but has fallen back from 61%. 17% now expect the industry to grow.

In the next 12 months the UK construction industry is more likely to:

The effect on projects

Main effect is increasing tender prices, mostly due to the weak pound. This may eventually lead to projects being cancelled.

Everyone is nervous and very cautious when it comes to development.

There has certainly been an increase in uncertainty around funding and I would anticipate in the longer term that a number of projects will move from fully funded to in doubt.

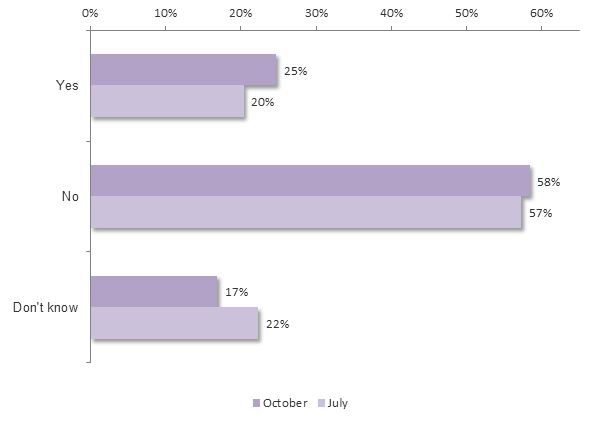

The above responses have given a picture of the near term future. What of the present? Whilst people are less pessimistic about the year to come, the immediate effects of the Brexit decision are being increasingly felt. Where one in five had had a project cancelled by July, that figure has risen to a quarter now. Of those who have had projects cancelled or put on hold, those projects account for, on average, 21% of current projects. That said, 7% have had projects re-instated that were put on hold after the referendum result.

As a result of the referendum have you had any projects cancelled or put on hold?

In conclusion

The issue is more nuanced than is generally assumed.

The true ramifications won't be felt for at least a few years

In the coming weeks we'll be rounding up the year in construction with a range of special festive content. Make sure you don't miss out by signing up to receive the NBS eWeekly newsletter. Get the latest content from theNBS.com carefully crafted into a handy weekly email.

Sign up to the NBS eWeekly newsletter