In a keynote speech to a DTI conference in 2005, the Hon Barry Gardiner MP commented on a report in the press which claimed that SMEs spent the equivalent of more than 14 years chasing payment.

It was revelations such as this, together with pressure from industry groups which prompted the latest review of construction payment practices, culminating in the Local Democracy, Economic Development and Construction Act, and the consequent amendments to the Scheme for Construction Contracts.

This article looks at the changes to the payment procedures brought about by the legislation. There are other changes to the adjudication procedures, for example, and the removal of requirement for contracts to be in writing, but generally speaking these relate to procedural issues regarding dispute resolution so are not addressed directly here.

The Scheme applies to non-compliant contracts (or to that part of a contract that does not comply). To conform to the legislation with regard to stage payments, construction contracts should now provide for the following main stages:

- Payment Due Date - the date each month when a payment becomes due.

- Payment Notice - a notice indicating the amount due on the due date (the 'notified sum') and the method of its calculation.

- Final Date for Payment - the date on which payment should be made.

- Payer's 'Pay Less' Notice - if the payer intends to pay less than the amount due, a notice to that effect, together with explanation.

The new provisions require a payment notice and a pay less notice to be given even if the amount due is zero. They also require payment notices and pay less notices to be served separately.

Let us look in more detail at some of these new notices.

Payment Notice (Section 110A)

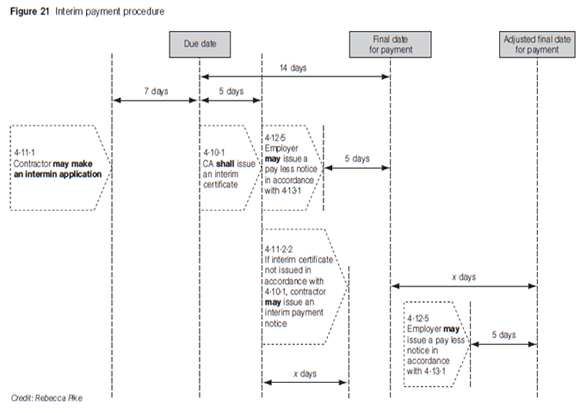

The contract may specify that either the payer or a 'specified person' may issue the notice to the payee, or the payee may issue the payment notice to the payer. This payment notice must be issued within 5 days of the payment due date.

'Specified person' means a person specified in or determined in accordance with the provisions of the contract - typically this will be the person administering the contract on behalf of the Employer.

Default Payment Notice (Section 110B)

This section applies in a case where, in relation to any payment provided for by a construction contract-

(a) the contract requires the payer or a specified person to give the payee a notice complying with section 110A(2) not later than five days after the payment due date, but

(b) notice is not given as so required.

In that event, the payee may serve a payment notice after the end of that period. Or, if the payee has already served a valid notice as part of their application for payment, then that notice becomes a default notice. This is probably the most significant change. Under the previous arrangement, there was no sanction for the payer failing to serve a payment notice. This meant there could still be a dispute about the amount due, even though there was no obvious contractual solution.

In each case, the notice must contain the sum that the person serving the notice considers to be or to have been due at the payment due date in respect of the payment, and the basis on which that sum is calculated;

The payer must then pay the notified sum (to the extent not already paid) on or before the final date for payment. This is described as 17 days after the payment becomes due, although the parties are free to agree a longer period.

Pay Less Notice (Section 111)

These replace the withholding notices under the previous version of the Act. If the payer does not want to pay the whole of the 'notified sum', the payer or the specified person must issue a pay less notice. The position remains largely unchanged from the previous Act/ Scheme. The pay less notice should be issued not less than 7 days before the final date for payment.

New prohibitions also include certain conditional payment clauses, such as pay-when-certified clauses. This is in addition to the previous situation which outlawed pay-when-paid clauses.

Section 111(10) of the Act provides that the requirement for a payment to be made on or before the final date for payment may be ignored, where the payee has become insolvent after the latest date for a pay-less notice, but before the final date for payment, therefore payment can be withheld in those circumstances.

This is a reflection of existing case law, such as Melville Dundas vs George Wimpey (see www.publications.parliament.uk/pa/ld200607/ldjudgmt/jd070425/melville-1.htm ![]() )

)

So how have the publishers of the most commonly used building contracts dealt with these changes?

Joint Contracts Tribunal (JCT) and the Scottish Building Contracts Committee (SBCC), have redrafted and republished the majority of their 'Standard' forms as 2011 editions. NEC have incorporated the changes in a revised optional clause Y(UK) 2.

The main result is that the contracts now specifically identify payment due dates, and default timescales. (See JCT SBC 2011 Clause 4.9.1). JCT have also set a default payment period of 14 days for interim payments.

ECC also have a payment period of 14 days. Interestingly, this is not significantly different from the existing provision in either contract - JCT '63 had a payment period of 14 days, as did NEC2.

Both publishers include the option for the Contractor to make an application not more than seven days before the due date.

Other changes resulting from the new Act include the right to suspend performance for non payment, this is dealt with in amendments to the JCT suspension provisions (see JCT SBC 2011 clause 4.14.2).

There are some interesting watchpoints in each contract, following the changes. In calculating the sum due, JCT now requires the Architect /Contract Administrator to take account of any payments made in respect of previously issued pay less notices. This means that certificates will now need to include deductions made, say, as a result of liquidated and ascertained damages - previously an area which was the exclusive domain of the Employer. It is not clear how this will work in practice, especially if they are not the Specified Person who makes these deductions. Under the circumstances, it may have been better to use the term 'notified' rather than 'paid', as it could be extremely difficult to ascertain if and when actual payment has been made. (JCLI, who produce contracts based on JCT for use in the landscape industry, have even gone as far as to set as a default that the 'specfied person' must be the Landscape Architect/ CA in a bid to head off potential confusion)

Another point to note is that ECC does not appear to have included the option for the Contractor to issue a default payment notice where the Project Manager does not issue the payment certificate within the specified period after the due date. This is, of course a statutory right, so the scheme will take precedence.

In summary, it is probably too early to say how well or otherwise the effect of the changes is being felt. Significantly, perhaps, the legislation allows the dates for payment and suchlike to be amended. It is probably the case that these will be done to the advantage of one party or the other, which could negate the intention.

On the other hand, it is an unfortunate fact that sometimes contractual rights are not enforced - sometimes to preserve goodwill and not to jeopardise future work. An example is the existing provision to add interest to late payment, which appears to be seldom used in anger.

Time will tell, of course, but if you do nothing else, it is time to brush up on your contract administration skills, and make sure you are using the correct version of the contract otherwise the situation could be even more complicated.